The case for a whole portfolio view

RIAs use multiple vendors and manual processes to maintain oversight of their portfolios including risk and performance analysis.

Everyday tasks and analyses as well as more structured, periodic client reporting requirements frequently rely on third parties and substantial internal efforts for aggregation of appropriate data to derive actionable insights to portfolio exposures, risk, stress testing and scenarios.

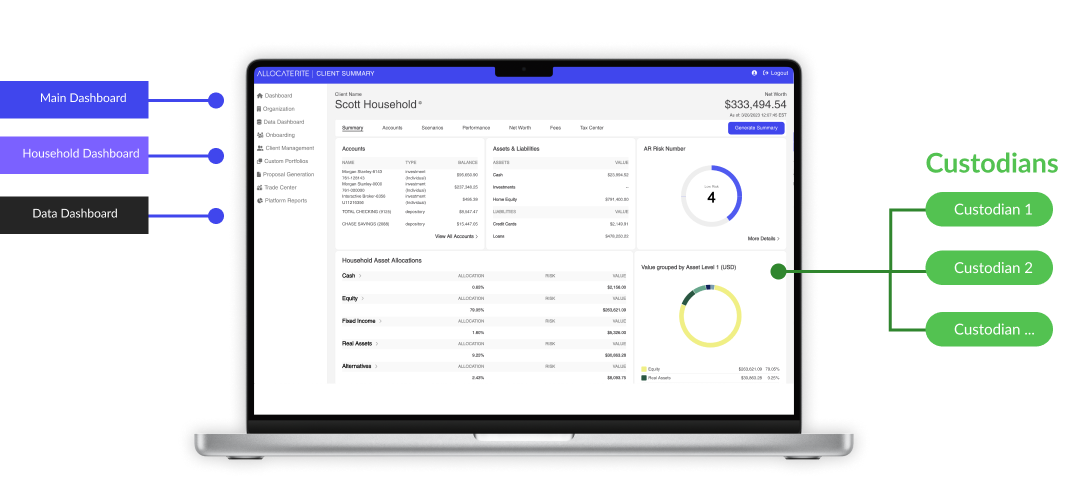

With Allocaterite Risk, the RIA has an all-in-one, integrated solution that provides actionable insight into the whole portfolio. Allocaterite focuses on bringing the data together, enabling the RIAs to more efficiently analyze, oversee, and manage the total portfolio, and to put in place a comprehensive risk management framework across asset classes and managers. In turn, this provides the RIA with the ability to autonomously understand portfolio exposures and risk, performance, asset allocation, stress tests and scenarios in a timely manner, leading to more efficient service.

Allocaterite's risk models are fully integrated across all asset classes allowing for a holistic view of the organization from the top down and the bottom up. These models include market driven scenarios and provide:

- Exposures and sensitivities, factor risk, stress testing and liquidity highlighting impact within and across asset classes

- Access to tools for interactive analyses

- Ability to export analytics for use downstream

Allocaterite's technology serves as the backbone of an asset manager's investment process across public and private assets—with an open architecture that gives clients and ecosystem partners the ability to “plug in”—for flexibility, optionality, and interoperability.

The Alllocaterite platform empowers sophisticated investment managers and RIAs to make more informed investment decisions, see through risk, capture market opportunities, and tap into scalable growth—for your stakeholders, as well as the end investor.

Take advantage of organic and inorganic growth opportunities, expand into new asset classes, and unlock your data—all while transforming a complex, multi-vendor environment into a deeply connected and scalable ecosystem.