Disclaimer: Any information you receive from AllocateRite is believed to be accurate. Nevertheless, neither AllocateRite nor its agents are liable for any deficiencies in the accuracy, completeness, availability or timeliness of such information. The information provided on this website does not necessarily reflect the most up to date or current information available on the product or service. The information contained herein is provided without any warranty of any kind. All the information above cannot be transmitted without AllocateRite consent. All the above materials are for informational purposes only. AllocateRite is registered with the Securities and Exchange Commission (“SEC”).

AllocateRite claims compliance with the Global Investment Performance Standards (GIPS®).

AllocateRite first claimed compliance with the Global Investment Performance Standards (GIPS®) standards on 3/24/2017, for the periods 01/06/2016 through current.

AllocateRite reviews a total firm AUM report broken out by account on a monthly basis to ensure that only actual assets managed by the firm are included. All accounts deemed to be advisory only, hypothetical, or model in nature are excluded from total firm AUM. AllocateRite currently reviews only firm AUM on a monthly basis. Composite AUM, is checked to eliminate any double counting of assets.

A GIPS report and/or the firm’s list of composite descriptions can be obtained upon request at [email protected]. GIPS® is a registered trademark of the CFA institute. The CFA institute does not endorse or promote this organization nor does it warrant the accuracy or quality of the content contained herein.

Actual composite performance includes dividends and dividends reinvested.

Actual Performance figures are reported in US $.

The indices/funds used by AllocateRite LLC have not been selected to represent an appropriate benchmark to compare an investor’s performance, but rather are disclosed to allow for comparison of the investor’s performance to that of certain well known and widely recognized indices/funds. Indices are typically not available for direct investment, are unmanaged and do not incur fees or expenses. Past performance is not indicative of future performance.

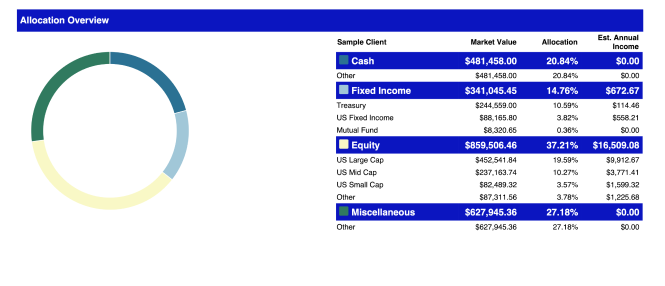

Any performance shown in USD for the relevant time periods is based upon composite results of the AllocateRite U S Domestic portfolios. Portfolio performance is the result of the application of the AllocateRite LLC’s investment process. The composite incorporates the relevant accounts managed by AllocateRite LLC.

Portfolio performance is shown net of the advisory fees of 0.50%, the highest fee charged by AllocateRite LLC and trading costs charged by their Custodians. Performance does not reflect the deduction of other fees or expenses, including but not limited to brokerage fees, custodial fees and fees and expenses charged by other investment companies. Performance results shown include the reinvestment of dividends and interest on cash balances where applicable. The data used to calculate the portfolio performance was obtained from sources deemed reliable and then organized and presented by AllocateRite, LLC.

The S&P 500 Index measures the performance of the 500 leading economies in leading industries of the U.S. economy, capturing 75% of all U.S. equities. The SPX/Barclays Index is a blend composed of 60% Standard & Poor’s 500 Index (S&P) and 40% Bloomberg Barclays U.S. Aggregate Bond Index (BC Agg) and assumes monthly rebalancing. The S&P is regarded as the standard for measuring large-cap U.S. stock market performance. The BC Agg is an unmanaged index that is widely regarded as a standard for measuring U.S. investment grade bond market performance.

Actual performance of client portfolios may differ materially due to the timing related to additional client deposits or withdrawals and the actual deployment and investment of a client portfolio, the reinvestment of dividends, the length of time various positions are held, the client’s objectives and restrictions, and fees and expenses incurred by any specific individual portfolio.

Copyright © AllocateRite Inc. All rights reserved.